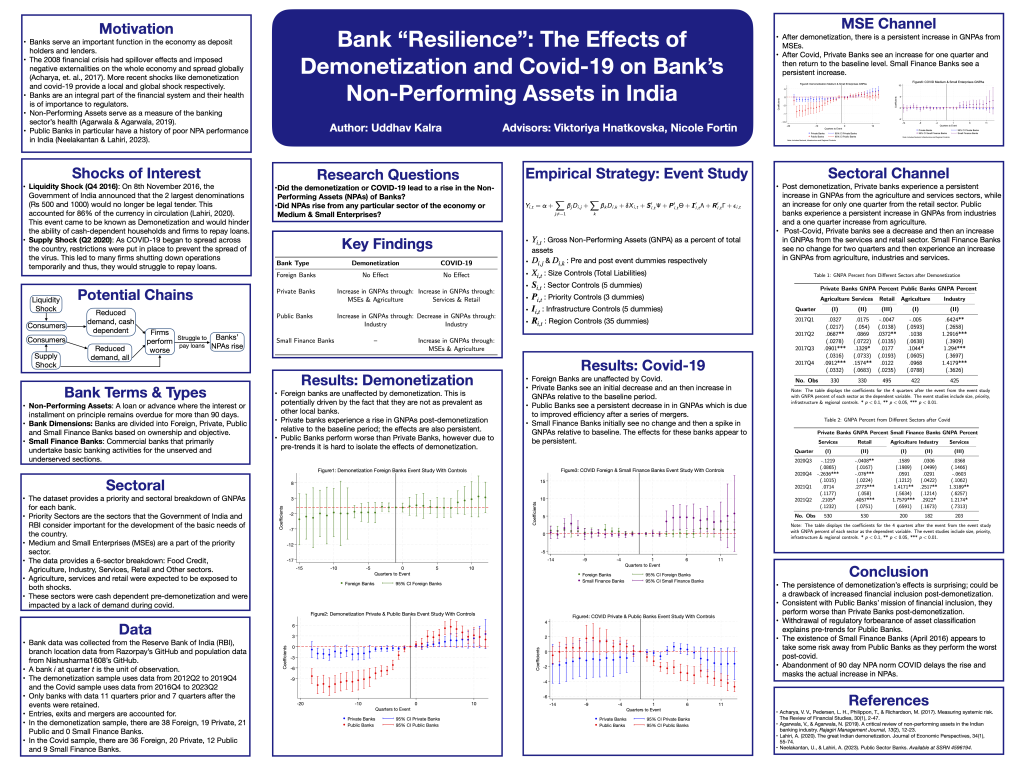

This paper examines the role of Demonetization and COVID-19 on the Non-Performing Assets of banks in India. Demonetization was the event where the Government of India decided that currency notes of denominations 500 and 1000 were no longer legal tender, this accounted for 86% of the currency in circulation. Exploiting variation in bank types and using an event study. I find that Foreign Banks remained unaffected from both events, Private Banks experienced an increase after both events, Public Banks experienced an increase after Demonetization and decrease after COVID-19 and finally, Small Finance Banks experienced an increase after COVID-19. Persistence of the effects of Demonetization for Private Banks could be a drawback of financial inclusion. The decrease experienced by Public Banks was due to a series of mergers that took place in April 2020.

This paper examines the role of Demonetization and COVID-19 on the Non-Performing Assets of banks in India. Demonetization was the event where the Government of India decided that currency notes of denominations 500 and 1000 were no longer legal tender, this accounted for 86% of the currency in circulation. Exploiting variation in bank types and using an event study. I find that Foreign Banks remained unaffected from both events, Private Banks experienced an increase after both events, Public Banks experienced an increase after Demonetization and decrease after COVID-19 and finally, Small Finance Banks experienced an increase after COVID-19. Persistence of the effects of Demonetization for Private Banks could be a drawback of financial inclusion. The decrease experienced by Public Banks was due to a series of mergers that took place in April 2020.